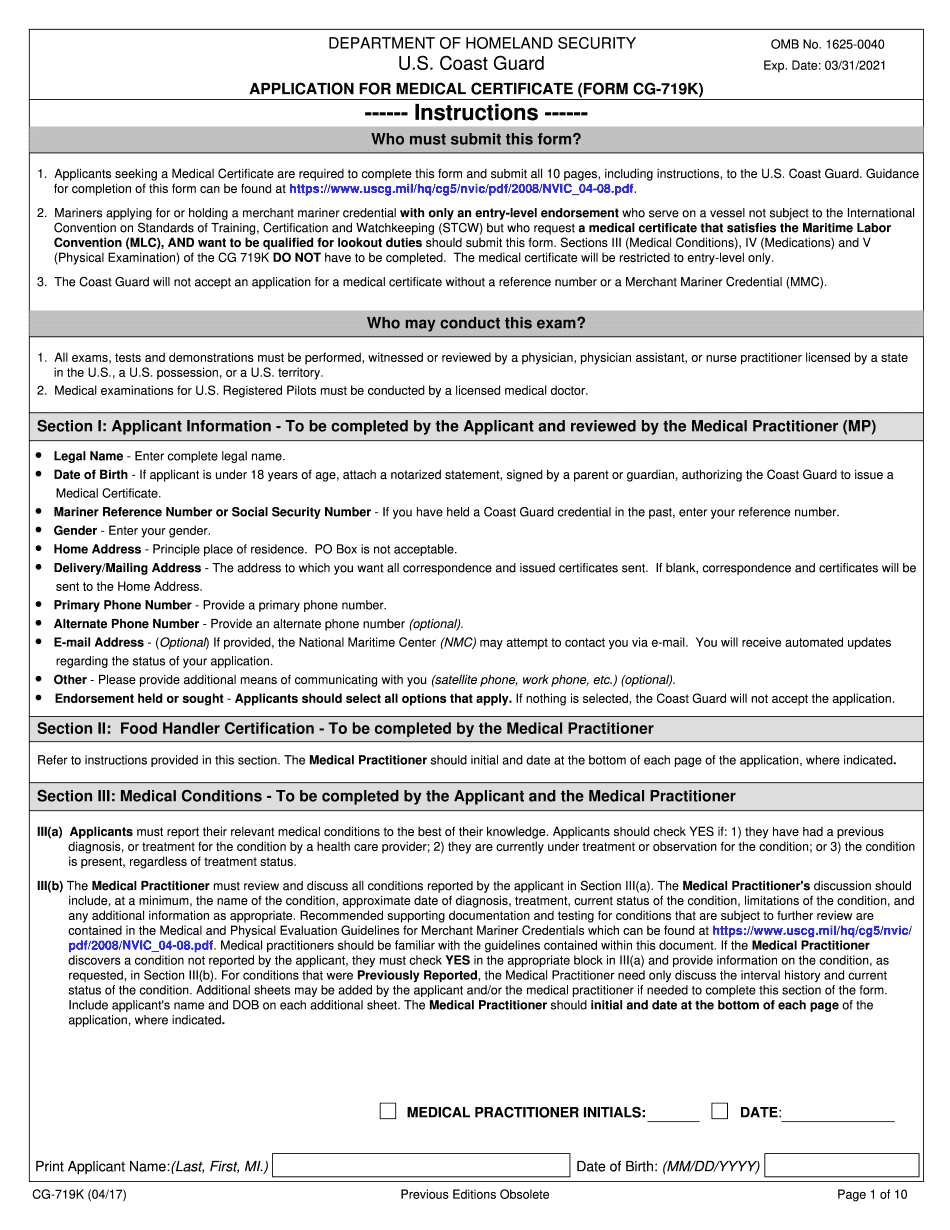

There are two parts a and B to section 2 which are medical conditions. Part A is to be completed by the applicant and reviewed by the medical practitioner. Part B down here is to be completed by the medical practitioner and what they'll do is for each yes answer they'll identify the item numbers the condition diagnoses day of onset of diagnosis and a bunch of other things, and they will fill it in on this paper here if they need to attach another sheet then they'll attach another sheet. You just need to make sure your name and date of birth is on the bottom which right here, applicant name last first middle here and date of birth when I talk to the Coast Guard about I asked them what is the most common mistake made on this form that gets it bounced back to people, and she said funny enough the mistake that's made most often is that people do not put their name and their date of birth at the bottom of each page. You'll see that page one out of five page two out of five here to get is again and on every subsequent page you must put your name and date of birth, so that's a little of a tangent. And let's get back to section two, so there's thirty-four of these boxes right thirty-four boxes, and they need to be checked either yes or no all the boxes. For every yes answer it goes into the hands of your medical practitioner, and they need to fill out in this space below the number you mark yes and then write out additional information right all about the condition you mark yes and make sure it's all correct. So that's about all for section...

PDF editing your way

Complete or edit your cg 719k anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export cg 719 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form cg 719k as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your uscg 719k by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Cg 719k

- Medical Certificate will be restricted to entry-level only for mariners serving on vessels not subject to STCW.

- Coast Guard uses this information to maintain and update records of merchant mariner documentation transactions.

- Failure to furnish requested information may result in the non-issuance of the MMC, any endorsement within the MMC, and medical certificate.

Award-winning PDF software

How to prepare Cg 719k

About Cg 719k

CG 719K is a form issued by the United States Coast Guard. Specifically, it is the Application for Merchant Mariner Credential (MMC), which is required for individuals seeking employment or working in positions on a vessel that is subject to Coast Guard authority. The CG 719K serves as an essential document for anyone looking to obtain or renew their mariner credentials. It is designed to collect personal information about the applicant, such as their legal name, contact details, social security number, date of birth, and employment history. Additionally, the form includes sections related to the type of credential being requested, the applicant's experience and training, and any relevant convictions or medical conditions. Individuals who may need to complete the CG 719K include commercial mariners, deck officers, engineers, and other crew members working on vessels operating in U.S. waters or internationally under U.S. jurisdiction. This form is necessary to demonstrate that the applicant meets the qualifications, experience, and medical standards required for the specific maritime position they seek or currently hold. Once filled out accurately and completely, the CG 719K is submitted along with required supporting documents to the U.S. Coast Guard Regional Examination Center (REC) for processing and evaluation. The Coast Guard's review process involves verifying the applicant's information, conducting necessary checks, and ultimately approving the issuance or renewal of the Merchant Mariner Credential.

How to complete a Cg 719k

- Make sure to complete all 10 pages, including instructions, and submit them to the US

- Coast Guard

- Legal Name: Enter your complete legal name in the Applicant Information section

- Medical practitioners conducting exams must be licensed in the US

- or its territories

People also ask about Cg 719k

What people say about us

Complicated paperwork, simplified

Video instructions and help with filling out and completing Cg 719k